New events are unfolding in the trade conflict between China and United States, as China allows the renminbi (RMB) to weaken. The People’s Bank of China let its currency devalue beyond the landmark seven-per-dollar threshold in an attempt to minimize the impact of additional tariffs set to be imposed by the Trump government in September. This is the first time, after more than a decade, that the Chinese central bank let the renminbi fall to such an extent.

This drop in the Chinese currency to a historic low is being seen as a response to the financial market forces. It allows China’s goods to be sold abroad at cheaper prices and aids businesses to compete well in a financial landscape with inflated tariffs. This 1.4 percent drop in the Yuan came just a week after American and Chinese negotiators met in Shanghai for face-to-face discussions, affirming that the negotiation talks were not successful.

The devaluation of renminbi has not been well received in the United States, where the American Treasury went on to label China as a currency manipulator – after years of refraining from using the harsh label formally in the past 5 currency reports. President Trump overtly expressed his disregard for the drop in RMB and attributed it to the China’s attempt to manipulate currency in order to gain trade advantage.

Director emeritus at the Peterson Institute for International Economics, C. Fred Bergsten, commented that the fall in currency may have been largely due to America’s own financial policies towards China and not the other way around. Hence, the label is somewhat unjustified unless there’s any evidence to prove otherwise.

Further devaluation of the Chinese currency will inevitably expose countries in East and Southeast Asia, with similar export goods, to market pressure as well. This ripple effect may negatively impact the inflation rates and necessitate further restrictive trade measures. Hao Zhou, a Commerzbank economist, said that we may expect the depreciation of the Asian currencies in the future which may escalate risk-off movements in global financial markets.

China can also be affected by a significantly weak currency itself. It could hurt companies that have either taken overseas loans in American dollars or depend on commodities that are priced in dollars – as the renminbi devalues, the pay back of debts will get more expensive.

Governor of the People’s Bank of China remarked that the devaluation of renminbi (RMB) was evidently a consequence of market forces but he is certain that RMB will maintain its strong position in the financial markets. The central bank also showed confidence in its ability to keep the renminbi exchange rate stable.

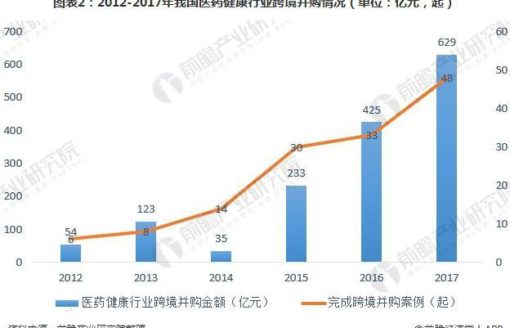

2018 年我国医疗健康行业并购市场分析:国内市场低迷、跨境热情高涨